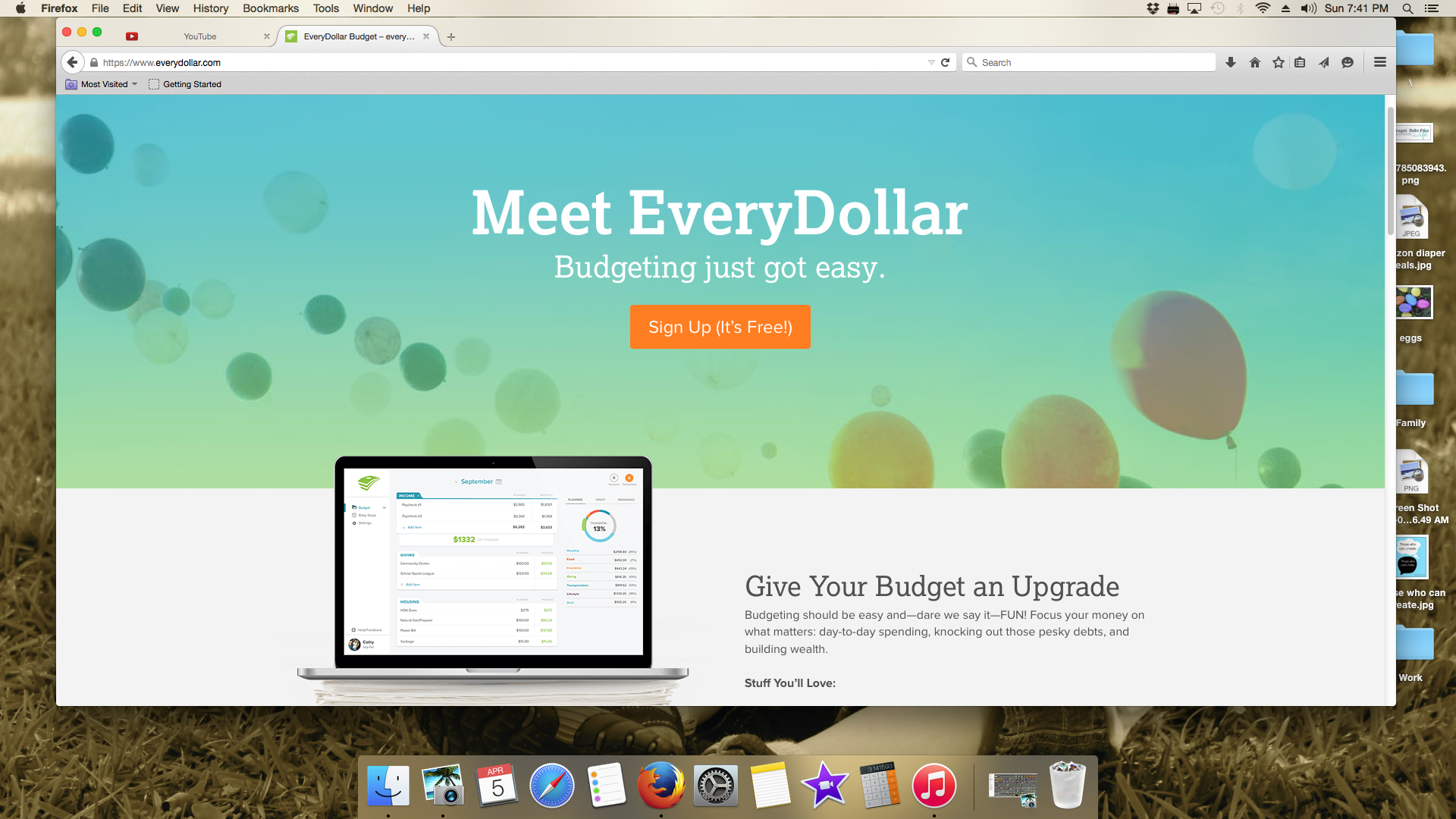

Build a budget with the EveryDollar Budget App

/It can be hard to build a budget and it can be even harder to stick to one. I know, I've been there.

But part of paying off debt or building toward savings goals is learning to live on a budget.

You just have to suck it up and do it.

My husband is a pen and paper person when it comes to making our budget. He likes to see all the numbers all at once.

I need immediate results, meaning I need to track my expenses as they happen. If I carry receipts around chances are they will get thrown away. And while I think cash envelopes are fantastic, I would just rather use my debit card.

But the EveryDollar Budget App from Ramsey Solutions (the Dave Ramsey people) helps marry my husbands need to see all the numbers with my instant budgeting needs. And no, they are NOT paying me for this post. It is not sponsored in any way.

And, it is like having a virtual cash envelope.

The app is INSANELY easy to use and it's FREE. You can go to the website and sign up and once you do you plug in your income and your budget.

It's completely customizable and there are line items for things you might forget like "pet care" or "club dues."

As you enter your purchases into your budget it automatically deducts them. So while you're standing in the Publix line you can swipe your debit card and then immediately enter it into the app.

Or, you can pay an annual fee for it to import the information from your bank account. I have not opted to do that.

If you don't have a smart phone you can use the app on any computer and it's a breeze.

It will also help you track your baby steps such as building your emergency fund, paying off your debt and socking away your 3-6 months of living expenses.

So, what about you? Are there any apps you use to save money?